housing allowance for pastors 2022

All states except Pennsylvania allow a ministers housing expenses to be tax-free compensation. The housing allowance is the most important tax benefit available to ministers.

Housing Allowance What You Need To Know The Better Way Planning Financial Support Why Is Planning Financial Support Important To Ensure Church Funds Ppt Download

If you normally get paid 50000 a year and your Church designates 30000 of that as housing you still only get paid 50000 in total.

. Designating a Housing Allowance for 2022. The housing designation doesnt cost your Church any money. The housing allowance for pastors is not and can never be a retroactive benefit.

Here at pastors wallet we talk a lot about the clergy housing allowance because its such a unique benefit for pastors. The church will reimburse for utilities including basic telephone and cable TV charges estimated to run approximately 3495 annually. For example in December of 202 1 a church agrees to pay its pastor total compensation of 45000 for 2022 and designates 15000 of this amount as a housing allowance.

I dont think the IRS would consider 100 an hour reasonable compensation for your service. Only ordained licensed or commissioned Clergy can designate a housing allowance and only for their ministry work and only for housing expenses for their primary. Here at pastors wallet we talk a lot about the clergy housing allowance because its such a unique benefit for pastors.

Back housing allowance ministers housing allowance is a valuable lifelong financial tool if managed properly. Do Pastors Really Have to Pay 153 for SECA. Back housing allowance ministers housing allowance is a valuable lifelong financial tool if managed properly.

Get the IRS to issue a private letter ruling regarding your specific situation. Your housing allowance is also limited to an amount that represents reasonable pay for your ministerial services. Here at pastors wallet we talk a lot about the clergy housing allowance because its such a unique benefit for pastors.

No further legal challenges to the housing allowance occurred in 2021. October 8 2021. Value of median-priced house x 1 x 12 Housing Allowance churchs recommended housing allowance would be 100000 times 1 or 1000 per month.

Ministers housing expenses are not subject to federal income tax or state tax. The CAC for 2022 is 71842. Start with these quick videos.

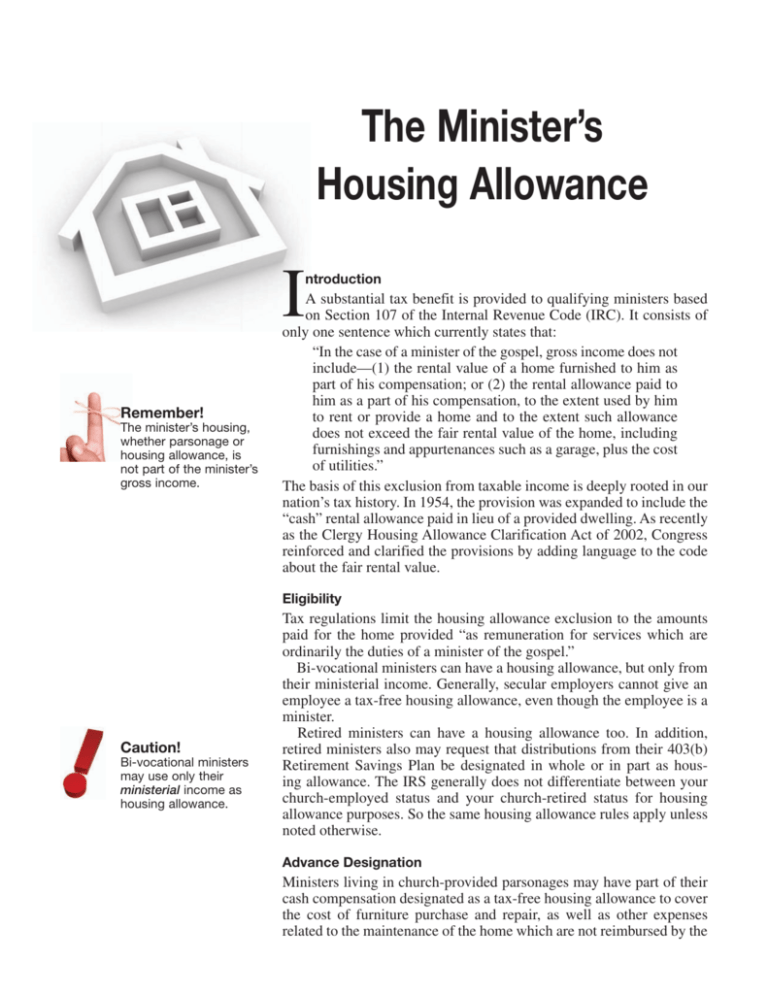

Not every staff member at the church can take this allowance. A unique feature of clergy compensation is the distinctive tax law regarding housing allowance for ordained ministers. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes.

Introducing The Pastors Wallet Online Community. Housing Fulltime pastors shall be provided with either a parsonage or a cash housing allowance in lieu of a parsonage. Churchs recommended housing allowance would be 200000.

The housing designation doesnt cost your church any money. That means that if you only work ten hours a week at the church then you cannot claim a 50000 housing allowance. The housing allowance for pastors is not and can never be a retroactive benefit.

A housing allowance is simply a portion of a ministers compensation that is so designated in advance by the ministers employing church. The housing allowance for pastors is not and can never be a retroactive. 10 Housing Allowance For Pastors Tips 1.

Why Do Church Employees Pay Self-Employment Taxes. How To Determine What Qualifies For The Clergy Housing Allowance. Back housing allowance ministers housing allowance is a valuable lifelong financial tool if managed properly.

The housing designation doesnt cost your church any money. The housing designation doesnt cost your church any money. Allowance for interim pastors living in a manse.

The remaining 30000 is salary. Mnuchin 919 F3d 420 7th Cir. To be used through June 2022 For all full-time pastors the church will be responsible for a pension benefit of 14 of total comp line 11 plus housing and will be billed directly by the conference office.

Start with these quick videos. The housing allowance is for pastorsministers only. If there is a parsonage available and the pastor chooses not to live in the parsonage then it is waived and they are not eligible for housing compensationallowance.

These can cost hundreds of dollars and are difficult to obtain. 2022 Compensation Guidelines for Ministers of Word Sacrament I. With an annual salary of 34681.

The IRS allows a ministers housing expenses to be tax-free compensation to the minister when the church properly designates a housing allowance. The housing allowance for pastors is not and can never be a retroactive. Find Free WordPress Themes and pluginsHousing Manse Parsonage Designation The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization.

This originated for clergy and the military because a parsonage was at one time standard for housing. While this Regulation does not require the designation. Constitutionality of the ministers housing allowance.

Help for setting this important clergy benefit before the new year. There are only three ways to find out for sure if something qualifies. Should continue to designate housing allowances for clergy.

The housing formula of 25-40 of CAC means that the housing compensationallowance for 2022 should be at least 1796050 and not more than 2873680. But many ministers do not take full advantage of it because they or their tax. Jan 23 2022 clergy tax deductions worksheet.

Start with these quick videos. If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount. Jan 23 2022 clergy tax deductions worksheet.

For less than fulltime pastors housing is a component of compensation to be negotiated between the pastor the church and the District Superintendent. Section 107 of the Internal Revenue Code clearly allows only for ministers of the gospel to exclude some or all of their ministerial income as a housing allowance from income for federal income tax purposes. The call includes an annual housing allowance of 10481 874 per month.

The CARES Act 2020 encouraged Americans to contribute to churches and charitable organizations by permitting them to deduct up to 300 of cash contributions whether. Start with these quick videos. February 28 2022 Video QA.

Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance By Amy Artiga

A Quick Guide To Oha Overseas Housing Allowance In 2022 Housing Allowance Allowance Overseas

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazon Com

Gehs Application Form Fill Out And Sign Printable Pdf Template Signnow

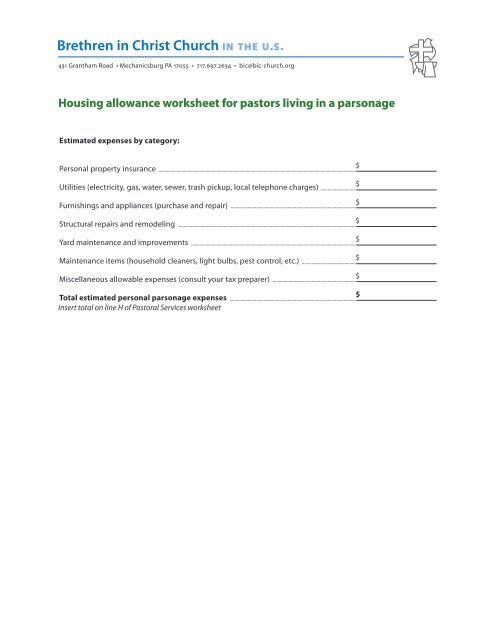

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

Allocating A Housing Allowance Church Law Tax

It S Time To Submit Your 2019 Housing Allowance The Pastor S Wallet

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance By Amy Artiga

Housing Allowance Fill Online Printable Fillable Blank Pdffiller

Update On The Minister S Housing Allowance Garbc

The Minister S Housing Allowance

Video Q A How Do You Get The Housing Allowance For A Pastor The Pastor S Wallet

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Kindle Edition By Artiga Amy Religion Spirituality Kindle Ebooks Amazon Com

Debunking 4 Housing Allowance Myths Outreachmagazine Com

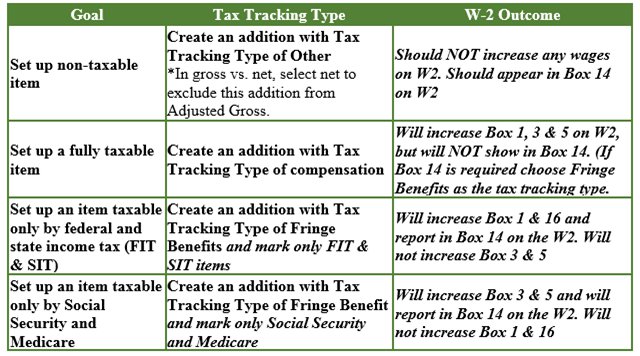

Payroll Set Up Housing Allowances For Clergy Members Insightfulaccountant Com

Video Q A Changing Your Minister S Housing Allowance The Pastor S Wallet